Making College Affordable: Providing Low-Income Students with the Knowledge and Resources Needed to Pay for College

Foreword

College affordability is a complicated and multi-faceted challenge. The price students and families are asked to pay has steadily increased over the past several decades, despite the existence of federal, state, and institutional grant programs, which are often not sufficient to fill the gap in need. Just as troubling, most students and families aren’t given clear and useful information about what they should expect to pay or how to navigate the system.

This is a challenge I worked on as a policy adviser in the Obama administration, and I’ve continued to work on it during my time at Lumina Foundation. At Lumina, we’ve suggested that the conversation around affordability be reframed around a concept we’ve called the Affordability Benchmark. We need to make college affordable by focusing on the student first—not on what tuition is, not on what aid is available—but on the student experience. Affordability should be defined by what is reasonable to expect students and their families to contribute toward their education, and this information should be shared with them in clear and predictable ways.

We need action on the part of states, institutions, and policymakers at all levels to make this a reality. The steps laid out here by the Jack Kent Cooke Foundation are clear, cogent, and compelling action items that every institutional leader should take seriously. Well-resourced institutions, in particular, should move forward quickly to implement these action items as evidence of their commitment to truly reshaping their practices in a way that benefit low-income students.

Ultimately, we need a better system of financing postsecondary education that frames affordability in a way that is clear and predictable, built around a defined benefit, and based on a reasonable contribution of resources available to students and families. The burgeoning path to a better reality for students has been made clear by this well-researched work—if institutions take these recommendations seriously, more students would likely enroll in college and be financially successful while there.

Dr. Zakiya Smith

Strategy Director, Lumina Foundation

Former Senior Adviser for Education in the Obama White House

Introduction

College can seem out of reach for many low-income students. Too often they believe college is unaffordable and unattainable. It is no surprise then that students from the bottom socioeconomic quartile are eight times less likely to earn a bachelor’s degree than students from the top socioeconomic quartile (7.4% versus 60%).¹

Even our nation’s brightest low-income students, who have done very well in high school and score highly on standardized tests, are less likely to obtain a college degree than their higher-income peers, a discrepancy known as the “excellence gap.”²

Several factors hinder students’ access and success. Low-income students may lack understanding of how financial aid works, or perceive they are unable to meet the full costs of higher education. Low-income students are more likely to suffer from “sticker shock” on seeing the ostensible price of a college education, to attend colleges closer to home to save money, and to pursue choices that allow them to work while in school. While state and federal funding can help to offset college costs, low-income students often are unaware that institutional aid can significantly lower costs and in some cases make college absolutely free. They do not understand the value of institutional aid, work/study policies, and loan forgiveness policies. They may not know how to apply for institutional aid required at some institutions, such as the completion of the College Board’s College Scholarship Service PROFILE and the Institutional Documentation Service (IDOC). Institutional aid could potentially play a much more important role in increasing access and persistence among low-income students, if these gaps in knowledge were removed. Colleges and universities have a role to play in educating low-income students about how to pay for college.

This brief offers 11 best practices to institutions to help students pay for college and stay in school. These strategies are organized into three categories: clarifying financial information, easing the financial burden, and filling in financial aid gaps. Specifically, we discuss how schools can provide students with better information to help them make more informed choices, to make going to college more affordable, and to understand how financial aid programs work so that they can maximize the aid they receive.

Clarifying Financial Information

The federal government has recognized that students have the right to data that can help them make the best decision regarding their education.³ Colleges thus make a range of information available to students, such as the price of attendance, graduation rates, and student body diversity. However, this information is disseminated in various ways that are not always the most user-friendly for the individual student. Some facts are distributed to all enrolled and prospective students or are available online to everyone, while others are available only upon request, or sent out in publications and mailings. Sadly, the information provided is often a confusing mess, and low-income students — often sorting through the data without a seasoned counselor at their side — must navigate these puzzles on their own.

Information that is only available upon request or through selected mailings puts low-income students at a disadvantage. Students may not be aware that the data even exist, much less that they should be seeking these figures. Lack of understandable information puts low-income students at a disadvantage, and they may incorrectly conclude that a college education is simply unattainable or may enter college without a full understanding of how to navigate the many financial aid programs, and ultimately drop out.

Schools should transparently provide all students with the relevant knowledge needed to make the best decisions about their education and paying for it. Schools can proactively support low-income students by providing clear, comprehensive information to all students, regardless of whether it is requested. This includes providing students with the most accurate figures available related to costs, financial aid, and student success, as outlined in our first five strategies below.

Strategy 1: Clarify financial aid letters

Accompanying many offers of admission is a financial aid award letter. These letters often use acronyms and abbreviations, and they may lump together scholarships and loans in ways that are difficult for students and families to understand.⁴ Variation in financial aid letters from school to school can make it difficult for students and families to compare offers.⁵

To address these issues and help families make more informed decisions about college, the U.S. Department of Education and the Consumer Financial Protection Bureau developed the “Financial Aid Shopping Sheet” in 2012. This form was designed to simplify information regarding cost and financial aid and allow students to easily compare institutions. Elements of this form include:

- Separation of loans from grants and scholarships.

- A concise statement that grants and scholarships are gifts that do not need to be paid back.

- The sources of grants and scholarships.

- The net (“actual”) cost of one year’s tuition.

- Clear language (e.g., no abbreviations or acronyms).

In an open letter to college and university presidents, the Department of Education asked institutions to adopt this form for the 2013–14 school year. As of January 2017, 3,278 institutions — including 60 selective institutions — have obliged.⁶ A copy of the form and a list of participating schools can be found on the U.S. Department of Education website. More schools are using this form every year. Schools should at the very least use it as a template to clarify the elements of their financial aid so students can compare offers.

Institutional award letters should make clear:

- The amount of grant aid the student is receiving, with clear language indicating that grants are gifts that do not need to be paid back.

- The source of each grant.

- Possible additional sources of funding (e.g., private scholarships) to pay the net cost (the difference between cost of attendance and grant aid).

- Clarification that loan amounts are suggestions, not requirements.

- A clear statement of how much money the student and family will need to pay, including an explicit statement that loans must be repaid.

- The net cost of attendance.

In addition, schools should make clear the terms of continuation of any aid:

- The requirements for maintaining each form of grant funding, such as grade point average requirements or minimum credit load requirements.

- A disclosure as to which grants must be renewed annually (including federal or state aid) with instructions on how to renew the aid.

Strategy 2: Provide students with a four-year estimate of expected costs

Unexpected rises in tuition can derail students, particularly those who may already be struggling financially to stay in school. Simply informing potential students that tuition prices may increase is not sufficient. While schools cannot be expected to know the exact tuition costs of future years, schools can project potential increases in tuition to help students make informed decisions and prepare for the next four to six years. Giving students an idea of the price of education for the duration of their schooling can allow students to budget and plan for potential tuition increases well in advance. Some schools have begun offering this information on their financial aid websites. Other schools can adopt these best practices:

- Towson University projects four-year university costs for fall 2017 through 2020.

- Manhattan School of Music provides estimated projected cost of attendance for 2017–18 through 2021–22.

- Culver–Stockton College provides estimated annual costs for the 2018–19 and 2019–20 school years.

- As of Fall 2017, several schools provide cost of attendance for the 2017–18 and 2018–19 academic years. For example, Sweet Briar College and Wesleyan College both provide data on two years of tuition and other costs.

Supplying future cost estimates is useful for students as they explore various colleges. An optimal solution would be a calculator that could estimate each individual student’s potential net cost (incorporating financial aid) over the course of college.

Strategy 3: Establish clear policies regarding financial aid eligibility requirements

Figure 1: FAFSA Text Reminder from the Common App. Source: “Using Texts to ‘Nudge’ Students on Financial Aid,” Education Week, October 11, 2016.

Most students who lose their eligibility for student financial aid do so because they lack the necessary grades, and therefore are unable to meet the “satisfactory academic progress” requirements of their aid program.⁷ Under the Student Right-to-Know Act, schools must make the conditions of satisfactory academic progress “available” to all benefit recipients.⁸ However, schools can meet the requirements of the statute in a number of ways. The most direct way would be by including these requirements in the same envelope with their financial aid award letters, but not all schools choose this option. Instead, schools frequently make this information available through publications or online.

Once students are enrolled, institutions should remind them periodically of requirements and deadlines. The Free Application for Federal Student Aid (FAFSA) form is a requirement for the Pell Grant, the federal government’s program for the most financially-strapped students, and for a number of other public and private scholarships. FAFSA completion is important for maintaining various forms of aid. Students are not always aware that FAFSA must be completed annually in order to continue receiving need-based aid. Schools should remind students of specific FAFSA deadlines. Research suggests that low-cost interventions, such as text reminders, improve students’ completion of FAFSA and other college related tasks.⁹ Many schools already communicate important information, such as emergencies, to students through email, text, and automated messages (Figure 1). Transmitting reminders about financial aid deadlines would benefit many who would otherwise drop out.

? Schools Offering Financial Aid Text Notifications

Strategy 4: Establish more robust methods for estimating non-tuition costs

Half of all undergraduates (50 percent) live off campus, while the remainder live on campus or at home.10 When providing financial aid, colleges are required to estimate living costs for students who are living on their own. However, estimating off campus housing costs can be challenging, resulting in dramatic variation of estimates of off-campus living costs among colleges, even between colleges in the same city. Researchers have found, for example, that college estimates of living costs in Washington, DC ranged from $9,387 to $20,342, while colleges in Milwaukee have estimated costs ranging from $5,180 to $21,276.11 Furthermore, researchers have estimated that one-third of colleges underestimate living expenses.12 The estimation of living costs has critical implications for students who depend on financial aid. Underestimationof living expenses can mean insufficient financial aid; overestimation can lead to students borrowing more money than they need.

Many schools survey students to obtain information on living costs. These surveys do not accurately estimate costs, because they capture what students are spending as opposed to what they need to spend.13 Under-resourced students may underreport costs, because they are missing meals, sleeping in their cars, or couch surfing.14 A survey of undergraduates at the University of California, Berkeley found that 23 percent of students reported skipping meals at least somewhat often to save money.15 On the other hand, wealthier students may report higher living costs than necessary.16

When estimating off-campus living expenses, schools should use standardized information or validate student-reported information with standardized data, such as data from the U.S. Department of Housing and Urban Development, U.S. Department of Agriculture Food Plans, and the U.S. Bureau of Labor Statistics. The significance of this information is too important to get wrong.

Strategy 5: Educate students about financial aid

Relatively few students have even minimal knowledge about financial aid. According to the 2015 Administrative Budget Survey, administered by the National Association of Student Financial Aid Administrators (NASFAA), over 70 percent of administrators at four-year institutions reported that students’ financial literacy was “limited.”17 Knowing the source and requirements of financial aid enables students to make better financial planning decisions.

Schools should encourage or require students to meet with a financial aid adviser before signing off on financial aid packages to ensure students understand their packages and make informed financial decisions. One study of financial aid recipients found that when students sought financial aid advising, they found it useful.18 Alternatively, schools should also offer webinars or videos that walk students through an example of a financial aid letter and discuss common questions or issues that students face to help them better understand their financial aid packages.

Some processes that ostensibly help facilitate approval of grants are problematic. For example, there are online systems that allow students to sign off on their financial aid packages without fully examining or understanding them. Further, a student’s parent may independently agree to a financial aid package if a student has consented to allow their parents access to their financial aid information. Parents should not be allowed to consent to burdens imposed on their children.

Examples of Financial Aid Educational Resources Offered by Schools

- Stony Brook University (SUNY)

Financial aid YouTube page covering a range of topics, including “Accept and Decline Aid” and “SBU Satisfactory Academic Progress Guidelines.” - University of California at Berkeley

YouTube page offers videos addressing various financial aid topics. Videos include a tutorial of UC Berkeley’s financial aid system. - University of Wisconsin-Milwaukee

Presentations for students and parents.

Easing the Financial Burden

As noted, rising college costs can make higher education seemingly unattainable for low-income students. They are more likely to forgo higher education entirely due to perceived financial constraints.19 It is no surprise that low-income families are more likely to find financial assistance critical in selecting a college, particularly in light of the high price of a college education.20 These students’ college choices may be limited to what they can afford rather than the best fit. For high performing, low-income students, this may mean sacrificing selectivity.

Once enrolled in college, low-income students are more likely to leave without obtaining a degree. Insufficient funds to meet basic needs and the requirement to work while in school contribute to the increased rate of attrition.21

Schools can help to ease the burden of financial stress and support low-income students in multiple ways, outlined in strategies 6 through 9 below.

Strategy 6: Prioritize need-based institutional grants

Over the last 20 years there has been a shift towards merit-based scholarships and away from need-based aid. In 1995, the majority of institutional award dollars were need-based.²² However, by 2003 the majority of institutional award dollars were merit-based.

Non-need-based aid, such as merit scholarships, is likely to attract students who can afford to pay for college. It also attracts students who are at the top of their class.²³ Accordingly, merit-based awards benefit institutions, but they can exacerbate the excellence gap by limiting aid to students who may need it the most.

In other words, wealthier students may be getting more aid than they need, while low-income students are unable to meet even their minimum financial requirements. A study by Postsecondary Education Opportunity suggests that students from lower-income families had greater unmet need than their higher income peers.²⁴ Another study found that more than a quarter of students from the top income quartile, or students from families that can afford to pay for college, received merit grants.²⁵ Accordingly, institutional aid that is used for merit aid hurts low-income students while not materially helping wealthier students as they have little to no financial need.

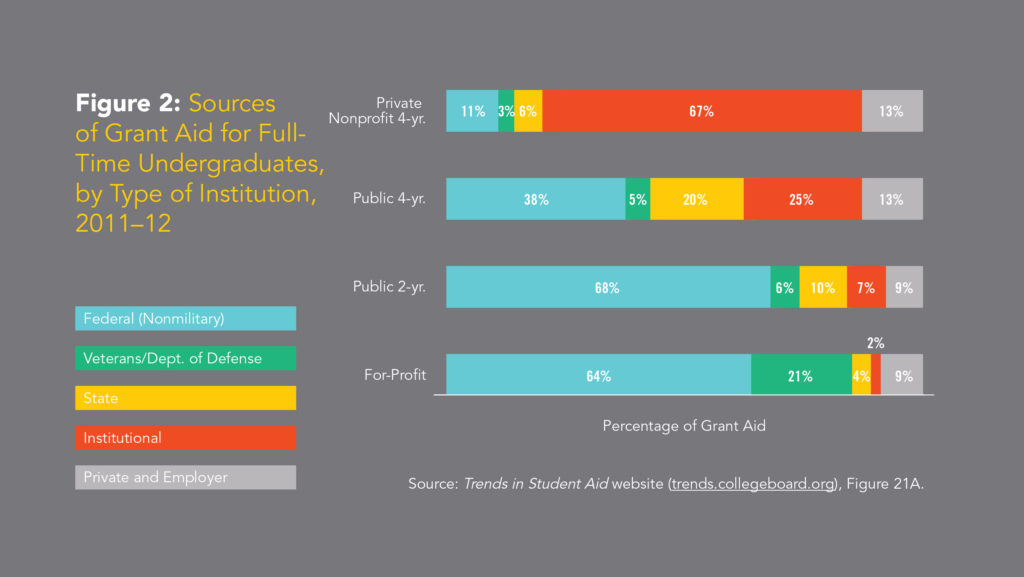

Institutional aid is an important source of financial aid, particularly among students attending private institutions (see Figure 2). In 2011–12, 67% of the aid received by students attending private four-year colleges came from institutional grants, and 25% of the aid received by students at public four-year colleges came from institutional grants.²⁶

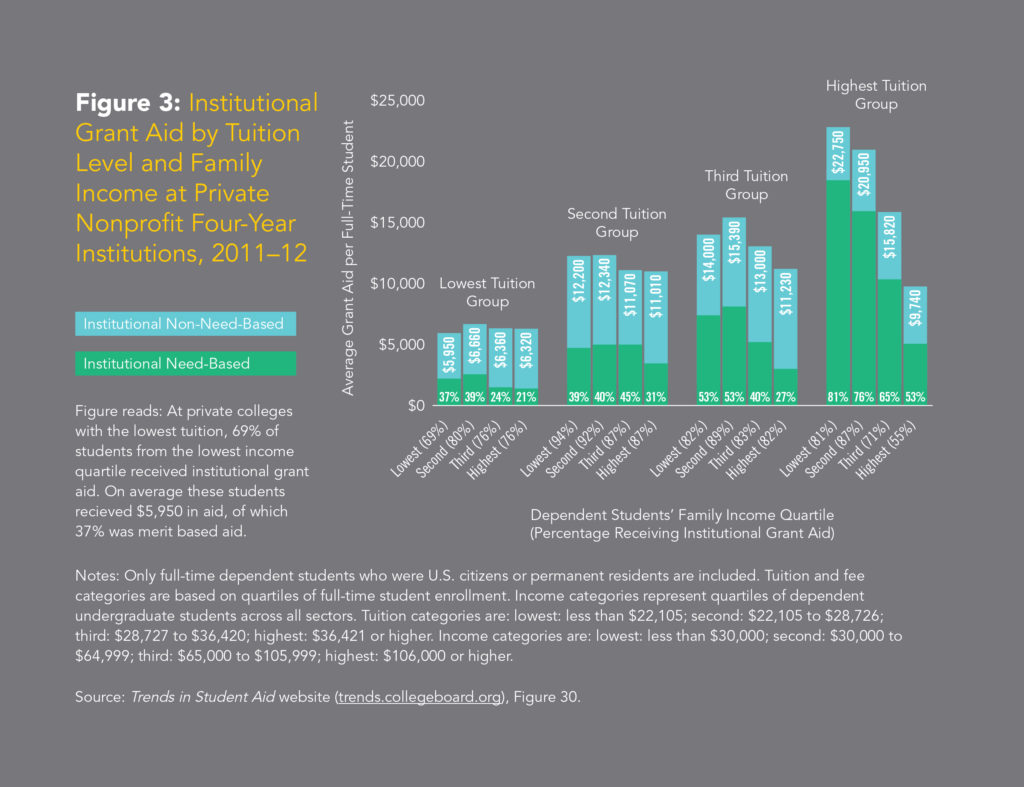

Closer examination of private colleges and universities shows varying practices in institutional aid. At the lowest-priced private institutions, low-income students actually receive less institutional aid than students from higher-income families, because of the merit aid awarded to high-income students. Unsurprisingly, at the highest-priced institutions, low-income

students, on average, receive almost double the institutional aid than students from the highest income quartile (see Figure 3).²⁷

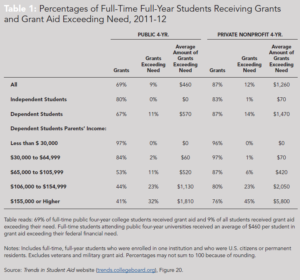

Additionally, high-income students are significantly more likely to obtain funding that exceeds their need (see Table 1).²⁸ Students in the highest-income bracket attending private four-year institutions received an average of $5,800 in aid exceeding their need. Almost half (45 percent) of students from the highest-income brackets that attended private institutions received grant aid beyond what their need dictates.

Figure 2: Sources of Grant Aid for Full-Time Undergraduates,by Type of Institution, 2011–12

Figure 3: Institutional Grant Aid by Tuition Level and Family Income at Private Nonprofit Four-Year Institutions, 2011–12

Table 1: Percentages of Full-Time Full-Year Students Receiving Grants and Grant Aid Exceeding Need, 2011-12

Strategy 7: Commit to maintaining grant levels for the duration of a student’s academic program

Students entering college may assume that grant funds will be stable throughout their college years. However, research indicates that institutional grant aid at private universities decreases by an average of $1,000 between freshman and senior year.²⁹ Just as unexpected tuition increases can derail students,³⁰ unexpected losses in grant funds can potentially interfere with a student’s educational progress, particularly when loss of grants are coupled with increases in tuition and fees. Schools should seek to maintain grant funds throughout the course of a student’s academic program, provided the student maintains minimum academic standards.

–Examples of Schools Committed to Maintaining Institutional Grant Levels for Four Years*

*Grants may be contingent on yearly application and changes in need

–Examples of Schools Offering Need-Based Grants Only

- Vassar College

- Stanford University

- Harvard University

- Northwestern University

- Franklin and Marshall College

Strategy 8: Do not reduce institutional aid when students receive private scholarships

Private scholarships can help students meet unmet need and reduce debt. Many students seek such scholarships to make college more affordable and to avoid taking loans. However, displacement of institutional aid undermines the purpose of private scholarships as the net price is not decreased and college does not become more affordable. In a survey of their scholarship recipients, the Dell Scholars program found that 60 percent of scholarship recipients were adversely affected by award displacement.³¹ When schools engage in displacement, they limit the benefit of private scholarships, particularly for low-income students. Scholarships should supplement institutional aid, rather than supplant it.

– Examples of Schools with a Policy of Reducing Loans and/or Work Study Before Institutional Grants

Strategy 9: Utilize low-cost textbooks

The cost of academic materials such as textbooks may place a burden on students with unmet financial need. The average cost of textbooks has increased by 73 percent over the past decade, and an individual textbook can cost over $200.³² With nearly all courses requiring a textbook,³³ these materials can add up quickly. Students may be forced to go without textbooks or purchase textbooks and make other sacrifices in return.

A study by the Lumina Foundation found that most instructors do consider the cost of textbooks when choosing course materials for their students.³⁴ Furthermore, faculty tend to be dissatisfied with the high cost of texts. One faculty member from the study is quoted as saying, “At a time when we are concerned about the cost of a university education and student debt, a $246 text is obscene.” Open-licensed educational materials or open textbooks can significantly reduce course material costs. Yet, the awareness of these alternative resources among faculty tends to be low.³⁵

The U.S. Public Interest Research Group (U.S. PIRG) argues that institutions are well equipped to address the issue of textbook prices through their libraries and support staff. They suggest a number of ways that schools can encourage the use of openly licensed materials.³⁶ Their recommendations include:

- Expand open textbook use on campus. Currently only five percent of courses use an openly licensedrequired textbook.³⁷

- Implement policies that demonstrate administrative support of, but do not mandate, open textbooks as a possible choice for course materials.

- Develop programs that provide training and coaching around the use of open textbooks.

- Offer faculty release time or stipends to explore open materials and incorporate them into their courses.

- Assign a chair or committee with the coordination of these efforts.

–Examples of Schools Providing Information About Open Education Resources

Filling in the Gap

Even with financial aid, some students still struggle to meet basic needs. Unexpected life events can present financial challenges that interfere with students’ studies. Over the past several years, schools have started identifying new strategies for helping meet students’ outstanding financial needs. These strategies include setting up emergency aid and integrating financial aid with public benefits.

Strategy 10: Set up emergency aid programs

Unexpected financial emergencies can interfere with students’ education and may lead students to drop out.³⁸ Food insecurity is also a growing problem among college students. Low-income students should not have to choose between purchasing textbooks and meeting their basic needs, such as eating and having a place to sleep. In one of the largest studies examining campus food insecurity, researchers found that 40 percent of students attending University of California campuses did not have consistent access to nutritious food and one-fourth said they had to choose between buying food or paying for education and housing expenses.³⁹ This research suggests that food insecurity and housing insecurity are far more pervasive than is generally understood. Inadequate nutrition may interfere with students’ ability to focus and threaten their academic progress. This may be particularly true for low-income students who are facing tight budgets. Emergency aid programs can help to relieve this financial pressure and keep students enrolled in college.

Private foundations have stepped into the gap. The Lumina Foundation funded two pilot projects — Dreamkeepers Emergency Financial Aid Program and the Angel Fund Emergency Financial aid Program — to provide support to students at risk of leaving school due to a financial emergency. They studied whether the students receiving Lumina’s aid stayed enrolled as a result of this support.⁴⁰ Evaluations of these projects showed that both students and administrators felt the aid helped students stay in school. Further, administrative data showed that re-enrollment rates of aid recipients were comparable to enrollment rates of the larger student body.

In their “landscape analysis” of emergency aid programs, the Student Affairs Administrators in Higher Education (NASPA), found that 74 percent of 706 institutions surveyed offered emergency aid programs, and that many had been implementing these programs for years.⁴¹ Most schools also offered more than one type of aid.

The primary types of emergency aid offered by institutions include:

- Campus vouchers (help students purchase books and food from the institution book store or dining hall)

- Completion scholarships (covers outstanding balances for students eligible to graduate)

- Emergency loans (short term loans)

- Food pantries

- Restricted grants (provided with criteria related to academic standing)

- Unrestricted grants (provided without criteria related to academic standing)

Recommendations to guide emergency fund programs based on these studies include:

- Develop a clear governance structure and simplify administration. NASPA’s landscape analysis showed that many schools integrated processes where departments (e.g., financial aid and student affairs) work together to administer aid. However, this can create a barrier to serving more students as the processes can become cumbersome. Indeed, in their evaluation of emergency aid programs, researchers at MDRC, an education and social policy research organization, found that students sometimes felt the process of applying for aid was burdensome.

- Advertise widely. NASPA found that schools often relied on word of mouth to advertise aid programs. Because funds are limited, schools are often hesitant to advertise widely. However, evaluations of Lumina’s Dreamkeepers and Angel Fund pilot programs found that demand for emergency aid was less than colleges’ initial fears.⁴²

- Diversify funding. Lack of financial resources is the leading reason why schools are not able to serve more students. University foundations, individual donors, and operating budgets tend to be the main sources of funding for institutions providing emergency aid programs. One way to expand these programs is to solicit funding from other sources such as alumni giving or through fundraising events.

Strategy 11: Integrate financial aid and social services

Public benefit programs (e.g., Supplemental Nutrition Assistance Program [SNAP]; Women, Infants, and Children Program [WIC]; and the Earned Income Tax Credit [EITC]) may provide an important source of financial support for students facing sudden financial challenges. However, many students may not be aware that they qualify for these benefits or know how to apply.⁴³ Several community colleges across the country have begun linking students to these benefits through organizations such as Single Stop USA, the Benefit Bank, and Seedco’s EarnBenefits.⁴⁴ For example, Single Stop USA is located at several community colleges and provides students with free services such as screenings and applications for public benefits, tax services, financial counseling, and legal services, as well as case management with referrals to resources at the institution and in the community. In their evaluation of Single Stop USA, the RAND Corporation found that Single Stop was associated with a material increase in college persistence, and that users of Single Stop attempted schedules with more credits than non-users. Tax assistance services were found to be particularly beneficial.

Initiatives such as the Benefits Access for College Completion (BACC) and the Working Students Success Network integrate access to emergency funds into traditional college processes.⁴⁵ For example, schools targeted specific students, such as those with no expected family contribution, and flagged student records to inform them to contact benefits staff, as they may be eligible for public benefits. Schools also housed public benefit services in campus departments such as financial aid. An evaluation of the BACC initiative found an increase in student retention and found that it helped students overcome unmet financial need.⁴⁶

While there are restrictions on college students receiving public benefits,⁴⁷ some exemptions apply that may allow some college students to qualify for benefits. For example, many low-income college students may qualify for one of the SNAP exemptions — one of the few public benefits available to individuals regardless of family status or disability.⁴⁸ Schools should consider partnering with organizations or providing staff with the tools to link students with public services that can help them meet their basic needs. Taking it a step further, University of Wisconsin–Madison has been working with the U.S. Department of Agriculture to become a SNAP retailer, which would make it the first college in the country to accept food stamps at cafeterias.⁴⁹ If successful, other institutions should consider this path.

– Single Stop USA School Locations

Conclusion

Low-income students face numerous barriers when it comes to the pursuit of higher education. They are frequently disadvantaged by a lack of support in navigating the complicated financial information needed to make the best educational and financial decision for their future. Once enrolled in college these students too often struggle to meet their basic needs, which undermines their academic performance and potentially threatens any grants or scholarships. Further, because of the lack of adequate funding, or the loss thereof, low-income students are left with enormous debt whether or not they graduate. Many school practices exacerbate rather than alleviate these barriers. Schools have a responsibility to students and must recognize that not all students have access to the same resources. Practices that reflect the disparate realities of low-income students ensure that all students have an equal opportunity to succeed.

This report identifies the best practices that schools should implement to support low-income students. Specifically, we recommend that schools:

- Clarify financial aid letters by distinguishing loans from grants and scholarships, noting that loans must be paid back, and clearly stating net costs.

- Provide students with a four-year estimate of expected costs.

- Establish clear policies regarding financial aid eligibility requirements, and include them in all financial aid award letters and communications.

- Establish more robust methods for estimating non-tuition costs to provide students with more accurate information.

- Educate students about financial aid by requiring or encouraging financial aid advising.

- Prioritize need-based institutional grants.

- Commit to maintaining grant levels for the duration of a student’s academic program.

- Do not reduce institutional aid when students receive private scholarships.

- Utilize low-cost textbooks.

- Set up emergency aid programs.

- Integrate financial aid and social services.

Helping low-income students pay for college and increasing students’ financial literacy takes more than just a financial aid check. It requires a commitment on the part of university administration and faculty members to consider both large and small financial obstacles standing in students’ path and to seek out ways to remove those obstacles. Adopting the eleven strategies outlined in this brief can help ensure more low-income students not only enroll in a college appropriate for their interests and abilities, but that they also persist through graduation without overburdening themselves with permanent debt.

Endnotes

¹ Keith Witham et al, America’s Unmet Promise: The Imperative for Equity in Higher Education. (Washington, DC: Association of American Colleges and Universities, 2015).

² Christina Theokas and Marni Bromberg, Falling out of the Lead: Following High-Achievers through High School and Beyond (Washington, DC: The Education Trust, 2014).

³ Various components of the Higher Education Act of 1965, as well as the 1990 Student Right-To-Know Act, reinforce this belief by requiring institutions to make public information on cost and outcomes (including graduation rates). The federal government also created the College Scorecard to inform students.

⁴ “First Test For College Hopefuls? Decoding Financial Aid Letters,” NPR.org, accessed December 8, 2016, http://www.npr.org/2014/04/03/298330444/first-test-for-college-hopefuls-decoding-financial-aid-letters.

⁵ Ibid.

⁶ “Financial Aid Shopping Sheet,” U.S. Department of Education, accessed November 16, 2016, http://www2.ed.gov/policy/highered/guid/aid-offer/index.html.

⁷ “Students Lose Financial Aid for Failure to Make Satisfactory Academic Progress,” Fastweb, accessed December 16, 2016, http://www.fastweb.com/financial-aid/articles/students-lose-financial-aid-for-failure-to-make-satisfactory-academic-progress.

⁸ “Information Required to Be Disclosed Under the Higher Education Act of 1965: Suggestions for Dissemination” (Washington, DC: National Postsecondary Education Cooperative, November 2009), https://nces.ed.gov/pubs2010/2010831rev.pdf.

⁹ John Balz, “A Conversation about Texting and Behavioral Science with Ben Castleman,” April 18, 2016, https://medium.com/@jpbalz/aconversation-about-texting-and-behavioral-science-with-ben-castleman-568f48690c9f#.prambl8b8.

¹⁰ Robert Kelchen, Braden J. Hosch, and Sara Goldrick-Rab, “The Costs of College Attendance: Trends, Variation, and Accuracy in Institutional Living Cost Allowances,” Wisconsin Hope Lab (paper presentation, annual meeting of the Association of Public Policy and Management, October 2014) http://wihopelab.com/publications/Wisconsin%20The%20Cost%20of%20College%20Attendance.pdf.

¹¹ Ibid.

¹² Ibid.

¹³ Sara Goldrick-Rab and Nancy Kendall, “The Real Price of College,” The Century Foundation, March 3, 2016, https://tcf.org/content/report/the-real-price-of-college/.

¹⁴ Rebecca Nathanson, “Tens of Thousands of College Students Have Nowhere to Sleep,” Rolling Stone, December 22, 2015, http://www.rollingstone.com/politics/news/tens-of-thousands-of-college-studentshave-nowhere-to-sleep-20151222.

¹⁵ Katherine Seligman, “Hidden Hunger: Some Students Are Scrimping, Skipping Meals to Afford a Cal Degree,” California Magazine (Cal Alumni Association), November 12, 2013, http://alumni.berkeley.edu/california-magazine/just-in/2016-03-08/hidden-hunger-some-studentsare-scrimping-skipping-meals.

¹⁶ Jill Barshay, “Underestimating the True Cost of College,” The Hechinger Report, June 1, 2015, http://hechingerreport.org/underestimating-the-true-cost-of-college/.

¹⁷ National Association of Student Financial Aid Administrators, “2015 Administrative Burden Survey”, April, 2015, http://www.nasfaa.org/uploads/documents/ektron/f5fdae89-a23f-4572-9724-15e5a9f614d2/0d73bf4cd48a43a6a9414b6ec1a6ab9d2.pdf.

¹⁸ Sara Goldrick-Rab, Paying the Price: College Costs, Financial Aid, and the Betrayal of the American Dream (Chicago ; London: University of Chicago Press, 2016).

¹⁹ Robert Bozick and Stefanie DeLuca, “Not Making the Transition to College: School, Work, and Opportunities in the Lives of American Youth,” Social Science Research 40, no. 4 (July 2011): 1249–62

²⁰ “A Benchmark for Making College Affordable,” accessed December 1, 2016, https://www.luminafoundation.org/files/resources/affordabilitybenchmark-1.pdf.

²¹ Mark Kantrowitz, “Why Do Students Drop out of College?,” Fastweb, December 17, 2009, http://www.fastweb.com/financial-aid/articles/whydo-students-drop-out-of-college.

²² Donald E. Heller, “Merit Aid and College Access,” in Symposium on the Consequences of Merit-Based Student Aid (March, 2006), http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.544.2863&rep=rep1&type=pdf.

²³ Christopher Drew, “A Rise in Students Receiving Merit Awards,” The New York Times, July 17, 2012, http://www.nytimes.com/2012/07/22/education/edlife/a-rise-in-students-receiving-merit-awards.html.

²⁴ Kim Clark, “Who Really Gets the Most College Financial Aid?,” U.S. News & World Report, October 19, 2009, http://www.usnews.com/education/blogs/college-cash-101/2009/10/19/who-really-gets-the-most-college-financial-aid.

²⁵ Heller, “Merit Aid and College Access.”

²⁶ “Sources of Grant Aid for Full-Time Undergraduates by Sector, 2011–12 – Trends in Higher Education – The College Board,” accessed January 24, 2017, https://trends.collegeboard.org/content/sources-grant-aid-full-time-undergraduates-sector-2011-12.

²⁷ “Institutional Grant Aid by Tuition Level and Family Income at Private Nonprofit Four-Year Institutions, 2011–12 – Trends in Higher Education – The College Board,” accessed January 24, 2017, https://trends.collegeboard.org/student-aid/figures-tables/institutional-grant-aid-tuition-level-family-income-private-nonprofit-four-year-2011-12.

²⁸ “Average Grant Aid at Four-Year Institutions: Need-Based, Non-Need-Based Meeting Need, and Exceeding Need, 2011–12 – Trends in Higher Education – The College Board,” accessed January 24, 2017, https://trends.collegeboard.org/student-aid/figures-tables/average-grant-aid-four-year-institutions-need-based-non-need-based-meeting-need-exceeding.

²⁹ Rochelle Sharpe, “Why Upperclassmen Lose Financial Aid,” The New York Times, April 6, 2016, http://www.nytimes.com/2016/04/10/education/edlife/why-upperclassmen-pay-more-they-may-get-less.html.

³⁰ Ibid.

³¹ Michele Waxman Johnson, “Private Scholarships Should Benefit the Student, Not the Institution,” The Baltimore Sun, July 15, 2015, http://www.baltimoresun.com/news/opinion/oped/bs-ed-scholarship-displacement-20150715-story.html.

³² U.S. PIRG, “Student Group Releases New Report on Textbook Prices,” February 3, 2016, [Press release] http://www.uspirg.org/news/usp/student-group-releases-new-report-textbook-prices.

³³ “Opening the Textbook: Open Educational Resources,” accessed December 5, 2016, https://www.luminafoundation.org/files/resources/opening-the-textbook.pdf.

³⁴ “Opening the Textbook.”

³⁵ Ibid.

³⁶ Ethan Senack, Robert Donoghue, The Student PIRGs, “Covering the Cost”, February 2016, http://www.uspirg.org/sites/pirg/files/reports/National%20-%20COVERING%20THE%20COST.pdf.

³⁷ “Opening the Textbook.”

³⁸ Christian Geckeler, “Helping Community College Students Cope with Financial Emergencies,” MDRC, July 2008, http://www.mdrc.org/publication/helping-community-college-students-cope-financial-emergencies.

³⁹ Suzanna M. Martinez, Katie Maynard, and Lorrene D. Ritchie, “Student Food Access and Security Study,” July 11, 2016. http://regents.universityofcalifornia.edu/regmeet/july16/e1attach.pdf.

⁴⁰ Ibid.

⁴¹ Kevin Kruger, Amelia Parnell, Alexis Wesaw, “Landscape Analysis of Emergency Aid Programs,” NASPA, accessed December 12, 2016, https://www.naspa.org/images/uploads/main/Emergency_Aid_Report.pdf.

⁴² “Helping Community College Students Cope with Financial Emergencies”

⁴³ “Benefits Access for College Completion,” CLASP, September 10, 2012, http://www.clasp.org/issues/postsecondary/pages/benefits-access-for-college-completion.

⁴⁴ Ibid.

⁴⁵ Ibid.

⁴⁶ Ibid.

⁴⁷ For example, students are prohibited from receiving SNAP benefits unless they meet one of the exemptions, such as having children, working at least 20 hours per week, or receiving Federal Work-Study.

⁴⁸ Elizabeth Lower-Basch and Helly Lee, “College Student Eligibility,” SNAP Policy Brief (Center for Law and Social Policy, June 2014), http://www.clasp.org/resources-and-publications/publication-1/SNAP_College-Student-Eligibility.pdf.

⁴⁹ Nico Savidge, “University of Wisconsin Moves to Let Students Use Food Stamps in Dining Halls,” La Crosse Tribune, March 7, 2017, http://lacrossetribune.com/news/state-and-regional/university-of-wisconsin-moves-to-let-students-use-food-stamps/article_2d15754c-27d1-56af-90c1-c4be05fc91b7.html.